Pakistan’s Carbon Market Policy: Vision, Challenges, and the Path Forward

Pakistan’s Carbon Market Policy is a forward-looking step towards mitigating climate change impacts while driving economic growth and empowering vulnerable communities. By addressing the challenges of institutional capacity, awareness, and investment, Pakistan can establish itself as a key player in the global carbon market, fostering sustainable development and environmental resilience for the future. The policy is built upon three key pillars: ensuring compliance with environmental laws, mobilizing investment for economic development, and promoting equitable benefit-sharing through social safeguards.

Framework for Carbon Credit Issuance and Trading

The newly introduced policy provides a legal framework to facilitate the issuance and trading of carbon credits for both national and international stakeholders. A one-window facility has been established to simplify the carbon trading process, creating a unified system for project developers and buyer countries. This initiative seeks to foster trust and transparency, making Pakistan an attractive partner in the global carbon market.

Carbon markets are designed to reduce greenhouse gas emissions by enabling the trading of carbon credits. These credits, each representing one ton of carbon dioxide equivalent emissions, can be sold by entities that emit below their allocated limits to those exceeding theirs. By regulating emissions, this system incentivizes reductions, promoting overall environmental sustainability.

The Mechanisms of Carbon Trading

Carbon trading operates through two primary systems: the cap-and-trade system and the baseline-and-credit approach. The cap-and-trade system sets an emissions limit, with regulatory authorities distributing allowances to industries. Entities exceeding their limits must purchase additional allowances, while those emitting less can sell their surplus. In the baseline-and-credit system, projects actively reducing emissions—such as renewable energy initiatives or forest conservation—can sell carbon credits as rewards for their efforts.

Empowering Local Communities

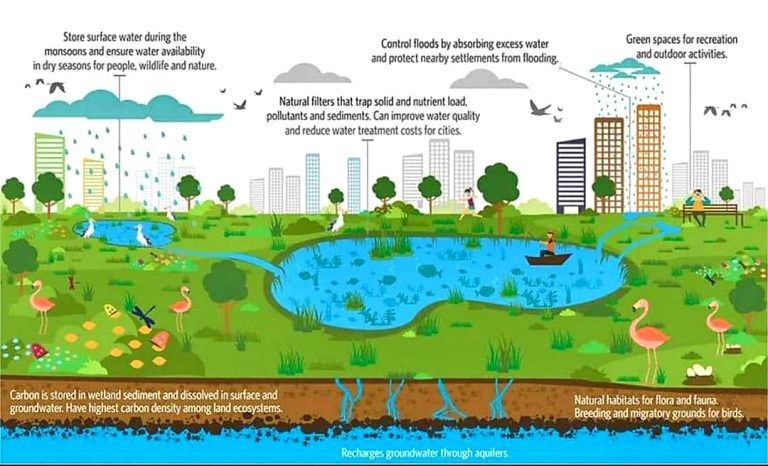

For Pakistan, carbon markets present a significant opportunity to benefit local communities affected by climate change. Initiatives such as reforestation, clean energy projects, and sustainable agriculture can provide income through the sale of carbon credits. Farmers adopting eco-friendly practices, for example, can earn additional revenue, which can then be reinvested into infrastructure, healthcare, education, and livelihood improvement.

Carbon market projects also empower communities by fostering environmental stewardship. Renewable energy installations and reforestation efforts not only generate income but also enhance local ecosystems. However, the success of these initiatives hinges on effective governance and equitable revenue distribution mechanisms. By aligning economic incentives with climate change mitigation goals, carbon markets can drive development in vulnerable communities while contributing to global emission reductions.

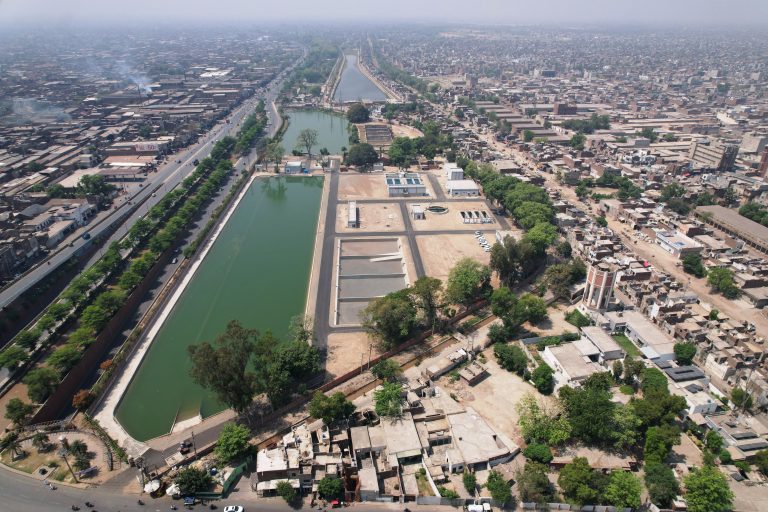

A Milestone in Pakistan’s Climate Action

Pakistan’s Carbon Market Policy represents a significant milestone in the nation’s fight against climate change. It encourages investment in sectors that can reduce carbon emissions, such as energy, agriculture, and forest conservation. The policy also positions Pakistan to supply offset credits to international carbon markets, ensuring transparency and traceability through a one-window facility for all transactions.

The country has set an ambitious target of reducing emissions by 50% by 2030, with 15% of this reduction achieved through domestic resources and 35% dependent on international funding. This commitment aligns with Pakistan’s obligations under the Paris Agreement, which calls for nations to meet their Nationally Determined Contributions (NDCs) by 2030.

The Potential and Challenges of Carbon Markets

Under Article 6 of the Paris Agreement, the establishment of international carbon markets was deemed essential for voluntary cooperation and carbon credit transactions. Pakistan stands to gain significantly, with potential earnings of up to $5 billion from these markets by 2030. However, achieving this requires effective management, a robust regulatory framework, and efforts to ensure benefits reach communities most affected by climate change.

Despite its potential, Pakistan faces several challenges in effectively participating in carbon markets and trading. Limited awareness among policymakers, businesses, and communities poses a significant hurdle. Additionally, the high initial costs of carbon reduction projects can deter investment. To overcome these challenges, Pakistan needs to strengthen institutional capacities, improve data systems, foster public-private partnerships, and focus on community-based carbon projects.